Accompanying sustainable agriculture: Perspective from Agribank and opportunities for developing Vietnam's Ornamental Plants industry

Vietnam’s agriculture is entering a period of strong transformation with a vision of “greening”, modernization and increasing added value. In that flow, the role of bank credit – especially from key state-owned commercial banks such as Agribank – does not stop at providing capital, but is increasingly becoming a strategic “lever” for agricultural economic sectors to develop in depth, sustainably and in connection with culture and community. The Ornamental Plants industry is one of the typical examples.

|

| Dr. Nguyen Huu Van - Chairman of the Vietnam Ornamental Plants Association spoke at the Workshop on disseminating knowledge on developing ornamental plants and shade trees with high economic value. Photo: Vusta. |

Credit has long been the “lifeblood” of Vietnamese agriculture. With its characteristics of large investments, long cycles, and high risks due to weather and diseases, the agricultural sector always needs long-term companionship and understanding from credit institutions. Over the past three decades, Agribank has maintained its role as the leading bank in “agriculture and rural areas”, with a wide network from urban to remote areas, accompanying millions of farming households, cooperatives, and rural enterprises.

By the end of 2024, outstanding loans to the economy will reach over VND 1.7 million billion, an increase of 11%, of which 65% of outstanding loans will serve the development of "Tam Nong", focusing on allocating capital for renewable energy, clean energy, industrial development, real estate business, consumer activities, services... Agribank will be provided with an additional VND 17,100 billion in charter capital from the State budget as planned, raising the total charter capital to VND 51,600 billion, contributing to improving financial capacity, creating a premise for sustainable development in the next period.

In addition to providing capital support, Agribank also implements a series of preferential credit packages, flexible according to seasons and regional characteristics, helping people to be proactive in production and reinvestment. At the workshop “Financial and credit solutions to promote rapid and sustainable development of “agriculture, rural areas” organized by the State Bank on the morning of October 9, 2024, Director of the Department of Credit for Economic Sectors Ha Thu Giang said that after 9 years of implementing the credit policy for agricultural and rural development (Decree 55/2015/ND-CP and Decree 116/2018/ND-CP), with policies such as unsecured loans, encouraging high-tech and clean agriculture, and encouraging the purchase of insurance in agriculture, up to now, credit for this area has three outstanding points.

First, the priority of investment in agriculture and rural areas by credit institutions has clearly changed. While in the past, the Bank for Agriculture and Rural Development of Vietnam (Agribank) played a key role, now there are more than 90 credit institutions and nearly 1,100 People's Credit Funds participating in lending to serve agricultural and rural development. The average credit growth rate for the agricultural and rural sector in the period 2016 - 2023 reached 16.3%, higher than the general credit growth rate of the economy. The credit scale for agriculture and rural areas accounts for 25% of the total outstanding debt of the economy, reaching 3.3 million billion VND by the end of September 2024.

Second, the basic credit source meets the demand for the agricultural product chain, from production, purchasing, processing, and export. In addition, credit capital is also lent to meet the consumption needs of individuals, households, and business households with outstanding debt of about 68.3%; Corporate debt balance is about 31.5%, thereby promoting trade and consumption in rural areas.

Third, credit capital contributes to promoting and maintaining the strength of key agricultural export products including rice, coffee, seafood, vegetables and fruits. Specifically, the credit ratio for these product groups has increased from 31% in 2016 to nearly 39% in 2023. By the end of 2023, credit for rice and rice increased by 24.09% compared to the end of 2022; seafood increased by 12.83%; coffee increased by 21.56% and vegetables and fruits increased by 11.33%; thereby contributing to the overall development of the agricultural sector.

As a bank that has been associated with the agricultural and rural sector since its inception, Agribank Deputy General Director Hoang Minh Ngoc informed that by September 30, 2024, Agribank's total outstanding loans reached over 1.6 million billion VND, of which outstanding loans for agriculture and rural areas were over 1 million billion VND with 2.8 million customers, more than double the figure in 2015 - when Decree 55 began to be implemented. With such results, Agribank is the bank with the largest market share in lending to the agricultural and rural sector in the banking system.

|

| Mr. Hoang Minh Ngoc - Deputy General Director of Agribank spoke at the conference "Promoting bank credit, contributing to promoting economic growth in region 8". Photo: Agribank. |

However, bank representatives confirmed that the implementation of credit policies for agricultural and rural development also encountered some difficulties and obstacles, affecting the effectiveness of credit investment in this field. Accordingly, credit institutions have difficulty in providing long-term, low-cost credit capital for the agricultural and rural areas because the main source of capital for lending to this area is currently capital mobilized from economic organizations and residents (mainly deposits), while these are short-term capital sources, mobilized according to market mechanisms.

In addition, unsecured loans only account for about 20% of outstanding agricultural and rural loans because the unsecured loan level for individuals and households stipulated in Decree 55 and Decree 116 is considered low and no longer appropriate. Outstanding credit balance in the agricultural and rural sectors for cooperatives is still low, due to small production scale, limited financial capacity, and management capacity...

For decades, the Vietnamese Ornamental Plants industry has quietly developed as a source of culture, contributing to beautifying the living environment and creating sustainable livelihoods for tens of thousands of rural households. From bonsai art, ornamental rocks, orchids to raising birds and ornamental fish - each ornamental plant product is not only the result of labor but also contains a philosophy of life, folk aesthetics and regional cultural identity.

The Vietnam Ornamental Plants Association (VAOS) was established in 1989 and has built a system of more than 400 clubs nationwide, with nearly 5,000 businesses, more than 11,000 gardeners and over 50 recognized craft villages. However, like many other specialized agricultural industries, Ornamental Plants still faces many difficulties in accessing bank credit.

According to many artisans, businesses and gardeners, one of the biggest challenges is that the Ornamental Plants industry does not have a specialized valuation framework, making it difficult for assets (trees, rocks, birds, rare fish, etc.) to be accepted as collateral. At the same time, many production facilities operate on a small scale, following the household model, lacking transparent financial documents, and not meeting the conditions for borrowing capital according to bank standards.

There are many cases where, despite having potential and a stable market, they are still unable to borrow capital to expand their scale due to a lack of collateral, or being forced to borrow too low a loan limit. This creates a paradox: a potential industry, with a wide open market, but unable to take off due to a lack of financial resources.

Understanding these difficulties, Agribank has been proactively coordinating with professional organizations to understand practical needs and propose appropriate credit models. Some branches in Ha Nam, Hung Yen, Nam Dinh, Can Tho... have tested lending forms through groups, professional cooperatives, or flexibly using collateral according to the valuation of physical assets according to the agreement.

In addition, Agribank is actively transforming digitally, applying technology to simplify loan procedures, proactively and flexibly applying loan security measures, valuing collateral assets, improving appraisal efficiency, assessing the creditworthiness of customers to increase unsecured lending on the basis of cash flow management and limiting risks. This is a direction suitable for the characteristics of industries such as Ornamental Plants - where many product values lie in the content of art, creativity and professional reputation.

On April 3, 2025, in Ha Tinh, Agribank attended the Conference "Promoting bank credit, contributing to promoting economic growth in region 8" co-chaired and organized by the State Bank of Vietnam and the People's Committee of Ha Tinh province. The conference was attended and directed by Deputy Governor of the State Bank of Vietnam Pham Quang Dung and leaders of the People's Committees of the provinces in the region, representatives of credit institutions and leaders of units under the State Bank.

|

| Overview of the Conference "Promoting bank credit, contributing to promoting economic growth in region 8". Photo: Agribank. |

Also during the meeting, Mr. Hoang Minh Ngoc - Deputy General Director of Agribank proposed a number of solutions to support the promotion of bank credit, contributing to promoting regional economic growth:

- Proposing that local authorities should pay attention to directing the reduction and simplification of administrative procedures to create favorable conditions for domestic and foreign enterprises to invest in the region; speed up the disbursement of public investment capital, remove difficulties for enterprises and people; pay attention to, create conditions to support, and promptly remove difficulties for credit institutions in credit growth.

- In addition, Departments/Branch/Associations have specific orientations and solutions to support people and enterprises in planning production areas, have a forecasting system, and orient output for agricultural products, especially products with high technology applications to ensure sustainable and effective development of agricultural credit. Pay attention to and provide timely support to credit institutions, act as a bridge for credit institutions to work with Departments, Boards, branches, and local authorities so that credit institutions can access key projects in the province and region early, accompany customers from the beginning of implementing investment plans and projects; thereby developing potential customers, increasing safe and effective credit growth for credit institutions in the area, and at the same time, contributing to promoting local economic growth.

- Propose that local authorities pay attention to effectively implementing the Project "Investing in the construction of at least 1 million social housing apartments for low-income people and industrial park workers in the period of 2021-2030" of the Government, localities complete the establishment, amendment, and supplementation of the Housing Development Program and Plan, publicize and introduce social housing investment land funds to enterprises for research and investment proposals; Balancing local budgets to encourage and provide additional incentives to call on economic sectors to participate in investing in developing social housing in the provinces in the region.

- Proposing that the State Bank of Vietnam promptly submit a Decree amending and supplementing a number of articles of Decree No. 55/2015/ND-CP dated June 9, 2015 of the Government on credit policies for agricultural and rural development, which has been amended and supplemented by a number of articles under Decree No. 116/2018/ND-CP to increase the maximum loan amount without collateral for customers in the agricultural and rural sectors, meeting the current reality of input prices for agricultural production, especially in the context of sharp increases in agricultural materials prices in recent times...

In the context of financial and banking information still unfamiliar to many members, gardeners, and bonsai artists, the media plays an important bridging role. Vietnam Fragrance Magazine - the mouthpiece of the Vietnam Association of Landscape Architects - has played a supporting role in disseminating policies, introducing effective production models, and connecting members with preferential credit programs.

Many successful ornamental plant models in recent times have shown that when capital flows are promptly cleared, creative and cultural values will quickly be realized into economic products. An orchid garden with thousands of flower pots, a hundred-year-old rock garden, or an influential bird-keeping artist - all are "living assets", capable of creating high value, contributing to the locality in terms of tourism, environment and employment.

The story of credit now is not just about capital, but about connection - about listening and sharing between banks, people and associations. From Agribank's perspective, each member of the ornamental plant association is not only a potential customer, but also a "storyteller" of a Vietnamese agriculture rich in identity, innovation and humanity.

Other News

Read more

Not water, but understanding makes ornamental plants flourish

Bioponic vertical garden: When green sprouts in the heart of the city

Breakthrough mechanisms needed to promote biotechnology application in Hanoi’s agriculture

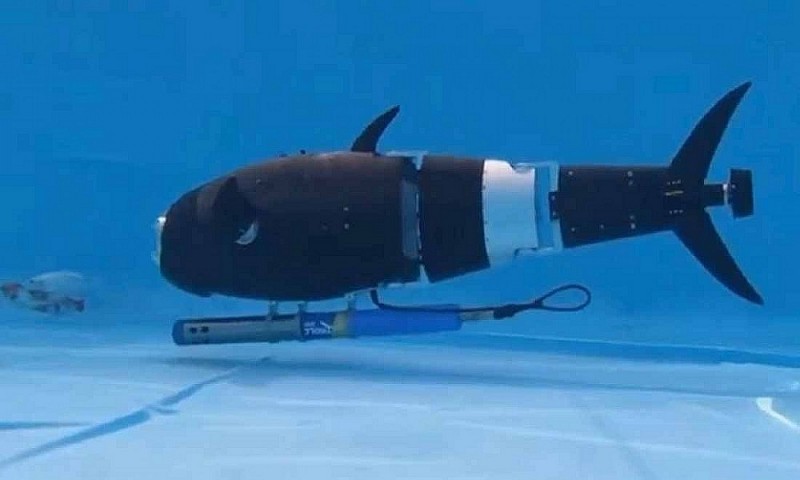

Fish robots: Technological solutions open the era of smart aquaculture

Air layering plants: An effective propagation method with great economic potential

Deteriorating air quality: Time for Hanoi to make bold investments in green spaces

Vietnam named one of Asia’s top wildlife watching destinations

Blooming money tree - A rare omen of wealth and prosperity

Bún Flowers: Hanoi’s hidden floral delight

The thousand-year-old "moving" banyan tree in Ninh Binh, each step takes a century

Hat Mon Temple – Historical Mark of Hai Ba Trung

Discovering 4 bird species that have captivated the Chinese for centuries

Vietnamese women and magnolia blooming seasons in Europe

Planting native species: A global trend for greener homes and bird-friendly spaces

56-year-old man living alone in the forest for 27 years with birds

Gazing at a 5,000-year-old olive tree in Greece

Phong Nha - Ke Bang National Park: Revival of 7 rare Indochinese tigers

The 9X artist turns water hyacinth into living art

6 Sarus Cranes complete quarantine, set to return to Tram Chim National Park

Hong Loan Mai – The graceful charm of a bonsai beauty

Endangered stork species making surprise appearance in Phong Nha - Ke Bang

Department of Crop Production and Plant Protection: "Orienting the total production value of flower and ornamental plant sector reach 70-75 trillion VND by 2025"

The 9X artist turns water hyacinth into living art

Over 1,000 artworks featured in the 2025 Expanded Ornamental Creatures Exhibition of Van Giang District

Endangered stork species making surprise appearance in Phong Nha - Ke Bang

Over 1,000 master bonsai trees gather in Quang Ngai, dazzling plant enthusiasts

Leaving a $1,000 office job, engineer turns cactus into food and drink

Hoa "Taxi" - A typical bonsai artist in Van Giang District, Hung Yen Province

Look inside the million-dollar jackfruit wood ancient house in Quang Nam Province

Van Phuc Silk Village: Weaving tranquility through memories and colors

Exploring Hat Mon Temple in Hanoi

From the first granule of urea to a national brand: PVFCCo and its mission beyond the continent

STP Group: Nguyen Thi Hai Binh - The pioneer woman bringing the ocean into the circular economy and the journey of "connecting values - connecting the community"

Toward the Celebration of the 63rd Anniversary of Lam Thao Superphosphate Company: From following President Ho Chi Minh’s wish to a national brand

Trailer introducing the special issue of Vietnam huong sac Magazine, published on May 19

Surprised by rare songbirds at Dung Tan Center in Thai Nguyen Province

A passionate horticulturist committed to preserving the Sanh Da bonsai lineage in Hưng Yên

Look inside the million-dollar jackfruit wood ancient house in Quang Nam Province